World Bank Financing Instruments

Accountability - Inspection Panel. The ongoing coronavirus COVID-19 outbreak is once again challenging the effectiveness of the World Banks Pandemic Emergency Financing Facility PEF.

The World Bank offers options to clients for converting the disbursed amounts to local currency.

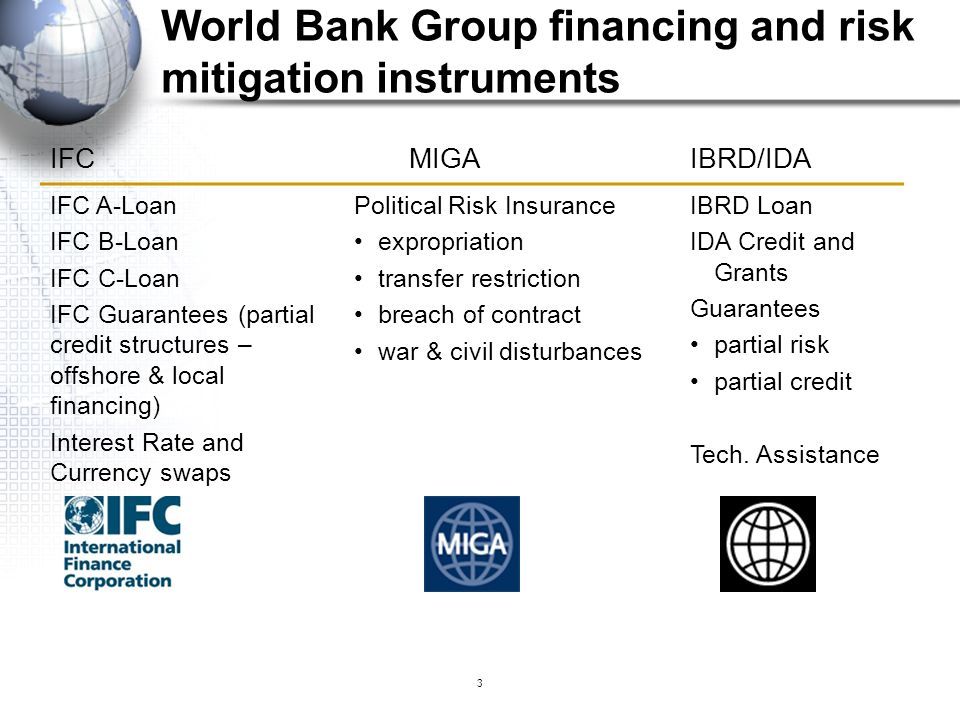

World bank financing instruments. The World Bank Groups Financial Instruments for Infrastructure Financial intermediaries investment funds and facilities. Financial instruments to strengthen financial resilience. Since joining the Banks Project Finance and Guarantees unit the predecessor of IFG in 1993 she has led the mobiliza-tion of financing for public and private infrastructure projects structuring public-private risk-sharing schemes and implementing World Bank guarantee transactions.

Investment Project Financing IPF is used in all sectors with a concentration in the infrastructure human development agriculture and public administration sectors. Development Policy Financing DPF is a World Bank lending instrument that provides credits loans grants or guarantees to a borrowing country through fungible ie. The team can support countries transitioning from low-income to middle-income status build capacity for new financing options as they graduate from grant-only to market-based financing instruments and work on unique challenges that require specialized financial.

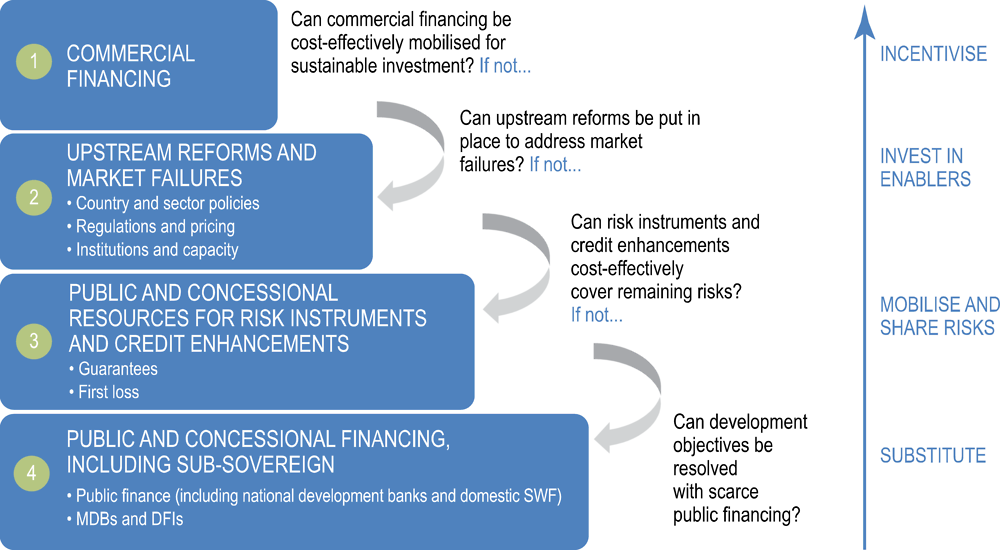

Together financing to meet their development objectives. The findings of the diagnostic can feed into the development of disaster risk. This papera product of the World Bank Group-wide Working Group on Innovative Financeis part of a larger effort to monitor and evaluate innovative fund-raising and financial solutions for development.

The choice of instrument depends on a clients needs and. IBRD and IDA can lend to a country to finance a financial intermediary or an invest-ment fund or other facility that would provide loans equity guarantees take-out financing or other financial support for several discrete. Banking Instrument BGSBLCLoan Issuance I am Harry a financial consultant in UK and I can help secure loans as working capital for your company to nurture expansion new-product developmentor restructuring of your companys operations management or ownership Bank Guarantees SBLC inclusive.

The World Bank Group can help identify these risks and. Propose options based on client needs. The World Bank Pakistan Housing Finance Project P162095 ii BASIC INFORMATION Is this a regionally tagged project.

The World Bank offers contingent credit lines that allows the clients to rapidly meet its financing requirements following a shortfall in resources due to adverse economic events or disaster. PforR is available to all World Bank member countries and is one of three financing instruments offered accompanying Investment Project Financing IPF and Development Policy Financing DPF. Development Policy Financing DPF provides rapidly-disbursing financing to help a borrower address actual or anticipated development financing requirements.

DPF supports borrowers in achieving sustainable shared growth and poverty reduction through a program of policy and institutional actions aimed at for example strengthening public financial management improving the investment climate. IPF is focused on the medium to long-term 5 to 10 year horizon and supports a wide range of activities including capital-intensive investments agricultural development service delivery credit and grant delivery including micro-credit community. Data can be categorized by country and fiscal year and is available to everybody to analyze visualize and share with others.

Finance Department of the World Bank. Credit Enhancement - Guarantees. World Bank Project Cycle.

Bank Instrument Monetization is a low-cost low-risk method of project or trade finance that monetizes inactive financial instruments by converting them into cash or cash equivalent by liquidating the instruments. World Banks innovative health financing instrument proved to be slow and late. And iii it provides the basis for new or deepened engagements on disaster risk finance by international partners as part of the broader disaster risk management DRM andor public financial management dialogue.

Up to 400 million of IDA PSW resources will be allocated under IFCs Global Trade Finance Program to fill a trade-financing gap in eligible countries that is now widening because of COVID19. Like MIGA World Bank guarantees help mobilize commercial finance for development. We also finance public projects to build physical and social infrastructure and develop institutional capacity.

Issuing guarantees to investors and making loans to host governments to fund guarantees. We finance government programs to support achievement of country development objectives and support policy and institutional reforms of national and subnational governments by providing budget financing and global expertise. Our clients face a range of risks and challenges in putting.

Renewable Energy Financial Instrument Tool REFINe REFINe can be used to identify financial instruments that can be used to overcome project risks and barriers. World Bank guarantees to mobilize commercial financing. World Bank Treasury Financial Products and Client Solutions team provides assistance in building capacity and developing innovative financing solutions for IDA-only members and IDA Blend countries.

The World Bank has two distinct financial vehicles to support developing country governments wanting to provide guarantees to attract private investors. World Bank Group Finances provides financing data and portfolio information including lending and disbursement data from across the World Bank Group. Countryies Financing Instrument No Investment Project Financing Situations of Urgent Need of Assistance or Capacity Constraints Financial Intermediaries.

This paper analyses the role of the World Bank in the inclusive financing of tourism as an instrument of sustainable development and compares it with the finance allocated to another four sectors in the branch of trade and industry. Companies in the poorest economies are struggling to continue their operations and are in critical need of payment-term extensions on their trade transactions so that they can ensure employment and the. As of FY2018 48 guarantee transactions using 74 billion in IBRDIDA commitments supported mobilization of 302 billion of commercial financing plus 20 billion of public financing.

PEF launched in 2017 after the 2014 Ebola outbreak in West Africa was touted as an innovative mechanism to. Monetization is quick easy and is accomplishable using a wide range of financial instruments such as bonds and bank guarantees to. The server has encountered an error which prevents it from fulfilling your request.

Please contact the system administrator.

International Financial Reporting Standards A Practical Guide 5th Edition

Trust Fund For Environmentally Socially Sustainable Development Tfessd

Imf World Bank Roll Out All Their Lending Tools

Beyond Aid New Sources And Innovative Mechanisms For Financing Development In Sub Saharan Africa

Capital Markets And Smes In Emerging Markets And Developing Economies Can They Go The Distance

Review Of Risk Mitigation Instruments For Infrastructure Financing And Recent Trends And Developments

The World Bank Group Instruments Ppt Video Online Download

Review Of Risk Mitigation Instruments For Infrastructure Financing And Recent Trends And Developments

Post a Comment for "World Bank Financing Instruments"